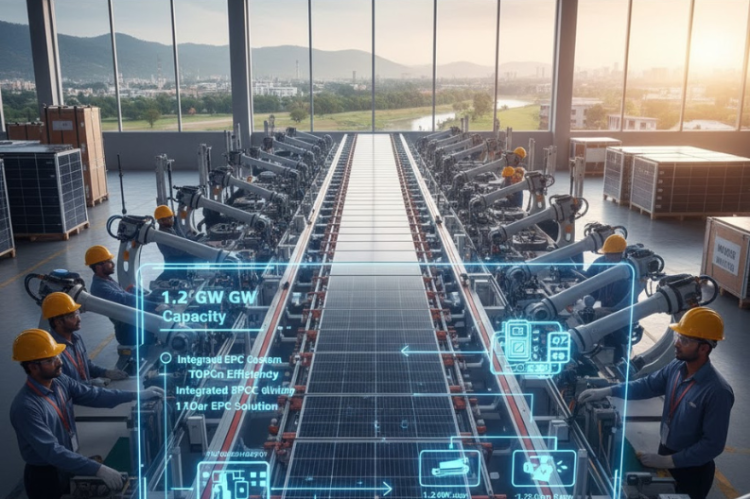

Solarworld Energy Solutions Limited has commissioned a 1.2-gigawatt high-efficiency TOPCon solar module manufacturing line at its Haridwar facility, marking a decisive step in its backward integration strategy. At the same time, this development aligns closely with India’s growing emphasis on domestic renewable energy manufacturing. As the country accelerates its clean energy transition, Solarworld’s move signals both strategic intent and operational readiness.

Importantly, the commissioning comes when the Indian government actively promotes local production of solar components. Through initiatives such as the ALMM framework and the PLI scheme, policymakers aim to reduce import dependence and strengthen supply chain resilience. Consequently, companies investing in domestic manufacturing stand to gain long-term advantages. In this context, Solarworld’s new facility positions the company to participate more effectively in government-backed and PSU-led solar projects.

According to the company’s investor presentation, the Haridwar unit represents a critical milestone in Solarworld’s evolution into a fully integrated clean energy solutions provider. Moreover, the adoption of TOPCon technology enables higher efficiency and superior performance compared to conventional modules. As a result, Solarworld can address both utility-scale and commercial solar demand with greater competitiveness, while simultaneously improving execution efficiency.

Notably, Solarworld has clarified that the primary purpose of the module line is to support its core engineering, procurement, and construction business. Rather than operating as a standalone manufacturing arm, the company plans to use most of the output internally. Therefore, Solarworld can internalize value that previously flowed to third-party module suppliers, strengthening cost control across projects.

During the Q1 FY26 earnings call, management highlighted that solar modules typically account for nearly 40% of EPC project costs. By manufacturing modules in-house, Solarworld expects to retain margins that would otherwise be ceded to external vendors. Consequently, this approach should provide structural margin support over the medium to long term, especially as project volumes scale.

Furthermore, the Haridwar facility forms part of a broader manufacturing roadmap. Alongside the module line, Solarworld is setting up a battery energy storage system assembly line and a junction box manufacturing unit at the same location. Both facilities are targeted for commissioning by early 2026. In addition, the company has initiated development of a 1.2-GW solar cell manufacturing facility in Pandhurana, Madhya Pradesh, expected to become operational by mid-2027.

Meanwhile, industry observers increasingly view backward integration as essential for solar EPC players. Volatile global supply chains and pricing pressures have underscored the risks of import reliance. Therefore, domestic manufacturing enables better cost predictability, faster execution timelines, and stronger bidding competitiveness in large tenders.

As India targets 280 GW of solar capacity by 2030, demand for domestically manufactured modules continues to rise. Against this backdrop, Solarworld Energy Solutions Limited believes its manufacturing-led integration strategy will support sustainable growth, enhance cost efficiency. And reinforce its role in India’s evolving clean energy ecosystem.