At a time when several non-banking financial companies across India face rising asset quality pressures, Choice NBFC Maintains Asset Quality Stability by following a disciplined and risk-aware lending strategy. For the first half of FY26, Choice International Limited’s NBFC arm reported a Net Non-Performing Asset (NNPA) ratio of 2.79%, highlighting the effectiveness of its credit assessment and portfolio management practices despite a challenging environment for lenders.

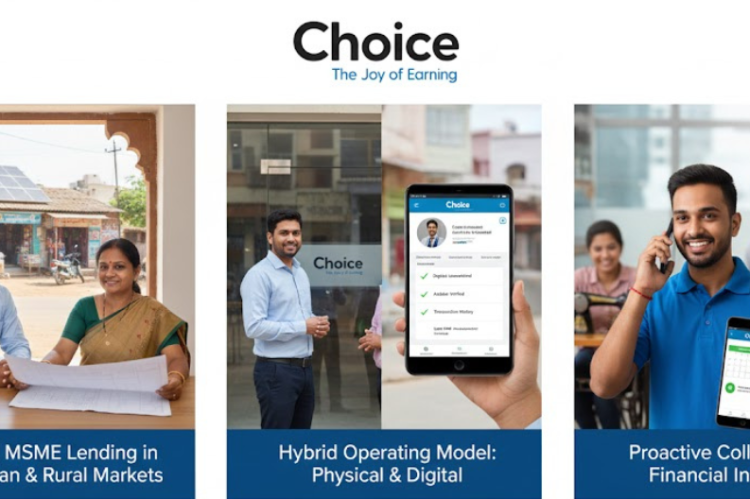

Importantly, management linked this stable performance to a conscious shift away from high-risk unsecured loans. Instead, the NBFC has focused on secured lending products designed for MSMEs and retail borrowers. These borrowers are primarily located in semi-urban and rural markets. During the earnings conference call, the company explained that its loan portfolio is largely anchored in loan against property, MSME business loans, and solar finance. These products offer stronger collateral coverage. As a result, they reduce downside risk. Although yields from such products are relatively lower, this approach helps protect portfolio quality. It also supports tighter control over credit costs over the long term.

Meanwhile, as of September 30, 2025, Choice’s total loan book stood at ₹716 crore. The retail segment contributed ₹536 crore to this total. During the quarter, net interest margins saw a modest contraction. However, management clarified that this was a deliberate trade-off. By reducing exposure to unsecured loans, which usually carry higher interest rates, the NBFC chose stability over aggressive growth. Consequently, the company reinforced its focus on sustainable expansion. It continues to prioritize long-term resilience rather than short-term profitability driven by elevated risk.

In addition, Choice’s NBFC stands out due to its hybrid operating model. This model combines physical branch-led sourcing with digital underwriting and processing. Physical branches enable direct customer engagement. This is especially important in underpenetrated regions where trust and local presence matter. At the same time, digital systems support credit evaluation, documentation, and ongoing monitoring. As a result, operational efficiency improves and turnaround times reduce. According to management, this integrated approach strengthens oversight of credit decisions. It also enhances customer accessibility across regions.

Meanwhile, collections efficiency has remained strong due to a proactive and structured approach. The NBFC operates with an in-house collections team that maintains close contact with borrowers. Furthermore, initiatives such as pre-EMI reminder calls and early outreach before due dates help customers plan repayments in advance. As management noted, these steps have played a critical role in sustaining healthy collections even as industry conditions remain volatile.

Beyond immediate financial performance, Choice views financial inclusion as a key long-term growth driver. By serving borrowers with limited access to formal credit and lower levels of documented income, the NBFC supports entrepreneurship and MSME development in semi-urban and rural India. At the same time, the company emphasizes prudent underwriting and localized risk assessment to ensure that growth in these segments remains sustainable.

Looking ahead, the company reaffirmed its commitment to cautious and consistent expansion. With continued emphasis on secured lending, technology-enabled operations, and deep on-ground presence, Choice NBFC Maintains Asset Quality Stability while positioning itself to navigate industry headwinds and support India’s emerging economic regions.