The world economy is changing. Goldman Sachs says global markets are entering a new “postmodern” phase.

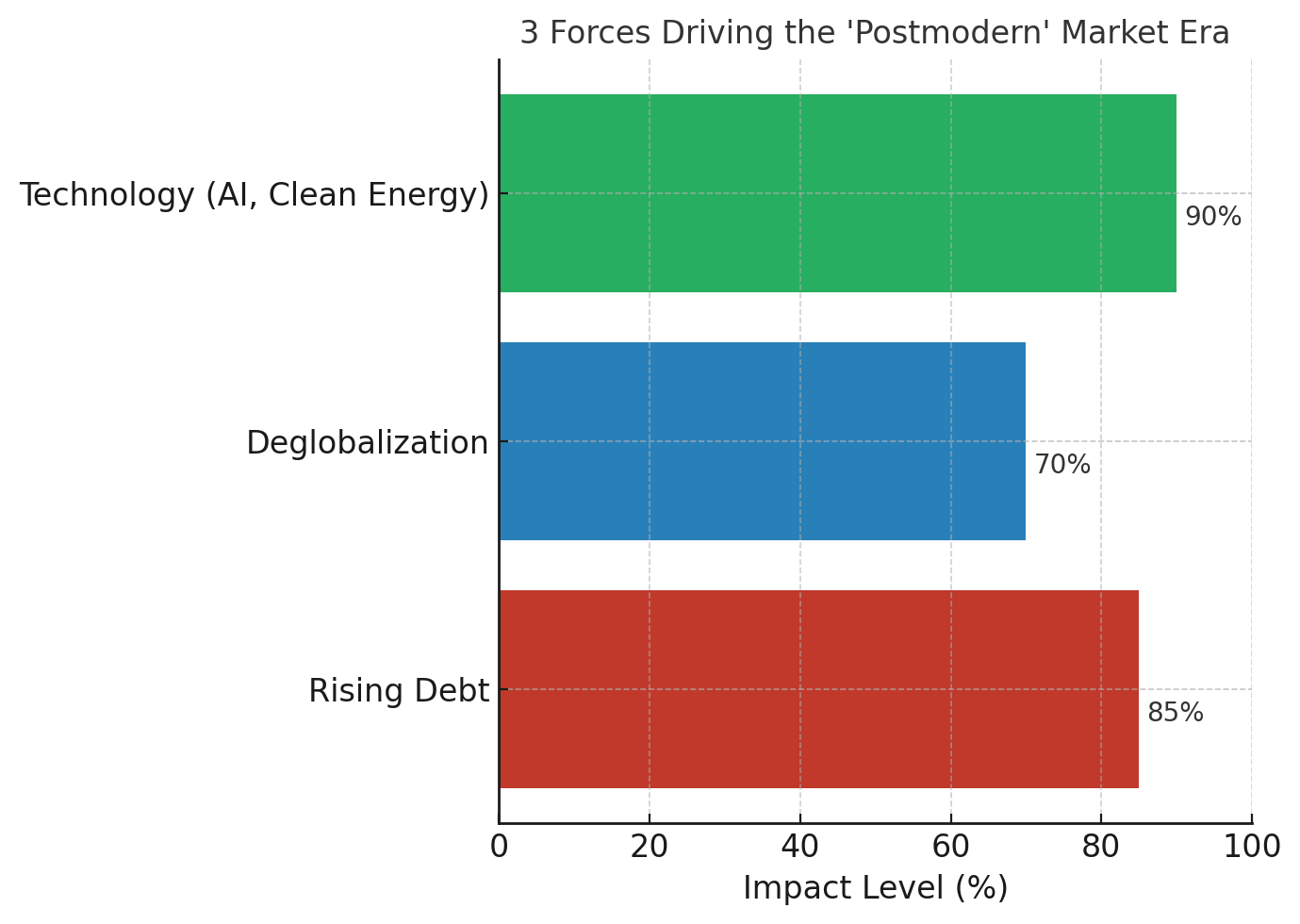

According to MarketWatch, this phase is shaped by three forces: rising government debt, deglobalization, and new technologies like AI. These factors are shifting how markets behave.

In the past, globalization and low inflation drove strong growth. Now, higher interest rates, trade tensions, and fractured supply chains are creating a different world. Countries are focusing more on domestic production and less on global trade.

At the same time, public debt levels are climbing. The U.S. debt is now above $35 trillion, and many advanced economies face similar pressures. That limits governments’ ability to spend freely during downturns.

Technology is another big driver. Artificial intelligence, clean energy, and digital infrastructure are changing where capital flows. Some sectors are seeing rapid growth, while others lag behind.

Goldman Sachs believes this new era could reward active investing. In the past, simply holding broad index funds worked well. But with markets splitting into winners and losers, picking specific stocks and sectors may matter more.

What This Means for Investors

- More volatility: Global tensions and debt may create bigger market swings.

- Sector gaps: Tech and energy may grow faster, while traditional industries struggle.

- Active strategies: Stock pickers may outperform index investors.

- Policy impact: Government debt and trade policies will heavily shape outcomes.

Bottom line: The easy years of cheap money and globalization are fading. A “postmodern” market means more complexity, but also new chances for smart investors.